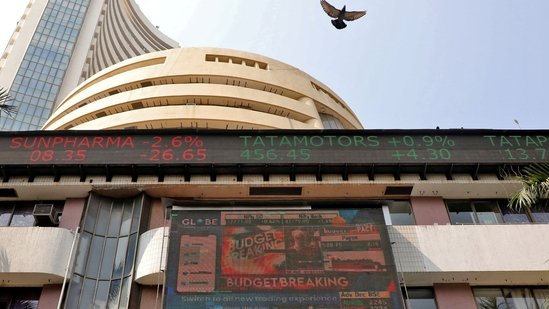

Today’s stock market: Sensex and Nifty 50 reached new all-time highs and continued to rise for the third straight session.

Stock market today: During the session, the Nifty 50 reached a new high of 24,661.25, and the Sensex reached a new record high of 80,898.3.

Today’s stock market: On Tuesday, July 16, the benchmarks of the Indian stock market, the Sensex and Nifty 50, increased for the third straight session, setting new all-time highs. Although cautious trading ahead of the Union Budget and poor global cues limited gains, purchasing certain heavyweight stocks propelled the market higher.

During the session, the Sensex reached a new high of 80,898.3 while the Nifty 50 reached a new high of 24,661.25.

The Nifty 50 finished at 24,613, up 26 points, or 0.11 percent, while the 30-share pack closed 52 points, or 0.06 percent, higher at 80,716.55. For both indices, this was also the new closing high.

July saw the local market go on an unprecedented rampage, propelled by hopes for a growth-oriented Union Budget, strong Q1 profits from Indian corporates, and consistent monsoon growth.

Gains have been constrained, though, because of worries about exorbitant market values. Even though the Nifty 50 has increased by 2.5% this month, it has still been in the green for eight of the last twelve sessions in July.

With few new triggers, the market has already discounted the majority of the factors. Experts predict that it won’t see a significant change until the budget is unveiled on July 23.

Investors have been booking profits in some heavyweights while purchasing shares of other companies with caution.

ICICI Bank, Hindustan Unilever, Bharti Airtel, and Infosys shares were the top mover of the Nifty 50 index. Conversely, as the top drags on the index, those of NTPC, Kotak Mahindra Bank, and Reliance Industries closed.

Among the global peers, top European markets were in the red when the Nifty 50 closed amid rising speculations that former US President Donald Trump was leading the presidential election race.

Opinion polls indicate Donald Trump and President Joe Biden are running a close fight, but the former president is leading in a number of swing states that might decide the election, according to a Reuters report.

Signals from the US Fed suggesting a possible rate decrease in its September meeting provide respite to the market.

At the Economic Club of Washington on Monday, Federal Reserve Chair Jerome Powell stated, as reported by Reuters, that “recent inflation data has strengthened policymakers’ confidence that price pressures are on a sustainable downward path.”

Top Nifty 50 gainers today

Shares of Coal India (up 3.01 per cent), BPCL (up 2.71 per cent) and Hindustan Unilever (up 2.44 per cent) closed as the top gainers in the Nifty 50 index.

Top Nifty 50 losers today

Shares of Shriram Finance (down 2.16 per cent), Kotak Mahindra Bank (down 1.99 per cent) and Dr. Reddy’s Laboratories (down 1.55 per cent) closed as the top losers in the index.

Sectoral indices today

Today’s closing sectoral indexes were mostly lower, with Nifty Media (down 1.03%) being the biggest loser.

The Private Bank index finished 0.09 percent lower, the Nifty Bank index fell 0.11 percent, and the PSU Bank index fell 0.25 percent.

Nonetheless, Nifty Realty (up 1.66%), FMCG (up 0.96%), and IT (up 0.59%) also saw respectable closing advances.

Expert view on markets

Head of research at Geojit Financial Services Vinod Nair noted that investors’ concerns over present valuations and muted expectations for Q1FY25 results prevented the domestic market from maintaining its early gains.

“This week marks the official start of the earnings season, which should provide investors a more comprehensive industry picture. The possibility of a rate decrease in September was raised globally by the Fed Chair’s dovish remarks about the trend of inflation and by the US 10-year yield dropping ahead of US retail sales data, according to Nair.

Senior VP of research at Mehta Equities Prashanth Tapse emphasized that investors continued to trade cautiously ahead of the Budget announcement, which kept the market rangebound throughout the afternoon. The sentiment was also influenced by feeble Asian and European cues.

“There are a lot of expectations from this Budget, and investors don’t want to rush into buying stocks; hence, they are in a wait-and-watch mode,” Tapse stated.

Technical views on Nifty 50

Kotak Securities’ head of equity research, Shrikant Chouhan, believes that 24,665/80,900 would be the first breakout target for bulls right now. The market may rise above this to 24,750–24,775 or 81,200–81,300.

Conversely, Chouhan stated that there might be a single swift intraday correction if the index falls below 24,550/80,500. It might retest the 24,500/80,300 level below. According to Chouhan, more declines might possibly occur, pushing the market down to 24,425/80,000.

On the hourly charts, Sharekhan by BNP Paribas technical research analyst Jatin Gedia noticed indications of a lack of momentum.

Bollinger bands have started to contract and the hourly momentum indicator has made a negative crossover, suggesting that there may be consolidation during the course of the next several trading days. According to Gedia, the consolidation range is probably between 24,700 and 24,500.